VAT Number Configuration

3.VAT Number Configuration

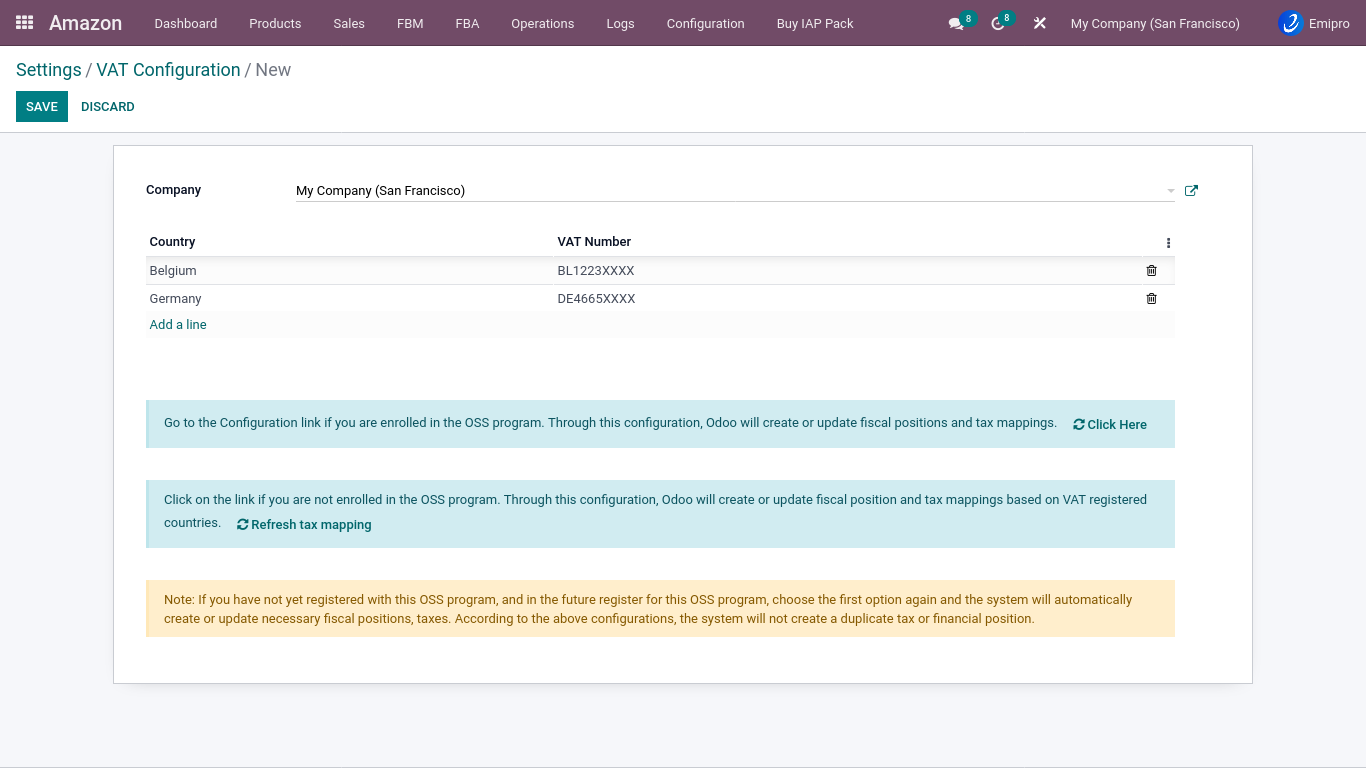

The seller needs to configuration their VAT numbers for each country using this screen.

- Navigate to Amazon ↣ Configuration ↣ Settings.

- Click on the VAT Number Configuration

-

If you are enrolled with the OSS program, then click on the **“Click here” button to redirect to Odoo configuration. This will create or update fiscal positions and tax mapping based on the OSS program.

-

If you are not enrolled in the OSS program, click on the “Refersh Tax mapping” button. Based on the registered countries for VAT, the system will redirect to the Odoo configuration and create or update fiscal positions and tax mapping.

-

The OSS program only applies to sellers from the European region.In the following link, Sellers can find basic information about the OSS program.

https://finance.belgium.be/en/E-services/Intervat/oss#q1

Note

If you haven’t yet registered with this OSS program, and do enroll in this program in the future, choose the first option again. The system will automatically create or update the necessary fiscal positions and taxes. According to the above configurations, the system will not create a duplicate tax or financial position. Moreover, all taxes must be configured with included in the price since Amazon provides inclusive tax unit prices for the orders.